WikiFX asked for payment to suppress fake negative reviews, broker reveals

Documents show how the broker review site sells visibility and trust to the highest bidder.

Editor’s note: WikiFX and its sister companies market themselves as a watchdog for retail traders, offering broker reviews and regulatory checks across forex and crypto. But documents and recordings suggest a different business model, one where brokers can pay to suppress complaints, boost their rankings and appear “verified”, regardless of actual oversight. Those that don’t pay up are slapped with low scores and warnings.

In this article, FXPrimus CMO Michael Margaritis reveals how the company was approached with exactly such an offer. The below is reprinted from Margaritis’ original LinkedIn post about his experience with the company with permission.

Time’s up. WikiFX was given 24 hours to remove every trace of FXPrimus from their platform and social channels. They chose not to. And If anything, I am a man of my word.

So now, we begin. The evidence is no longer private. You will hear what they said. You will see what they sell.

All backed by their official 2023 sales deck:

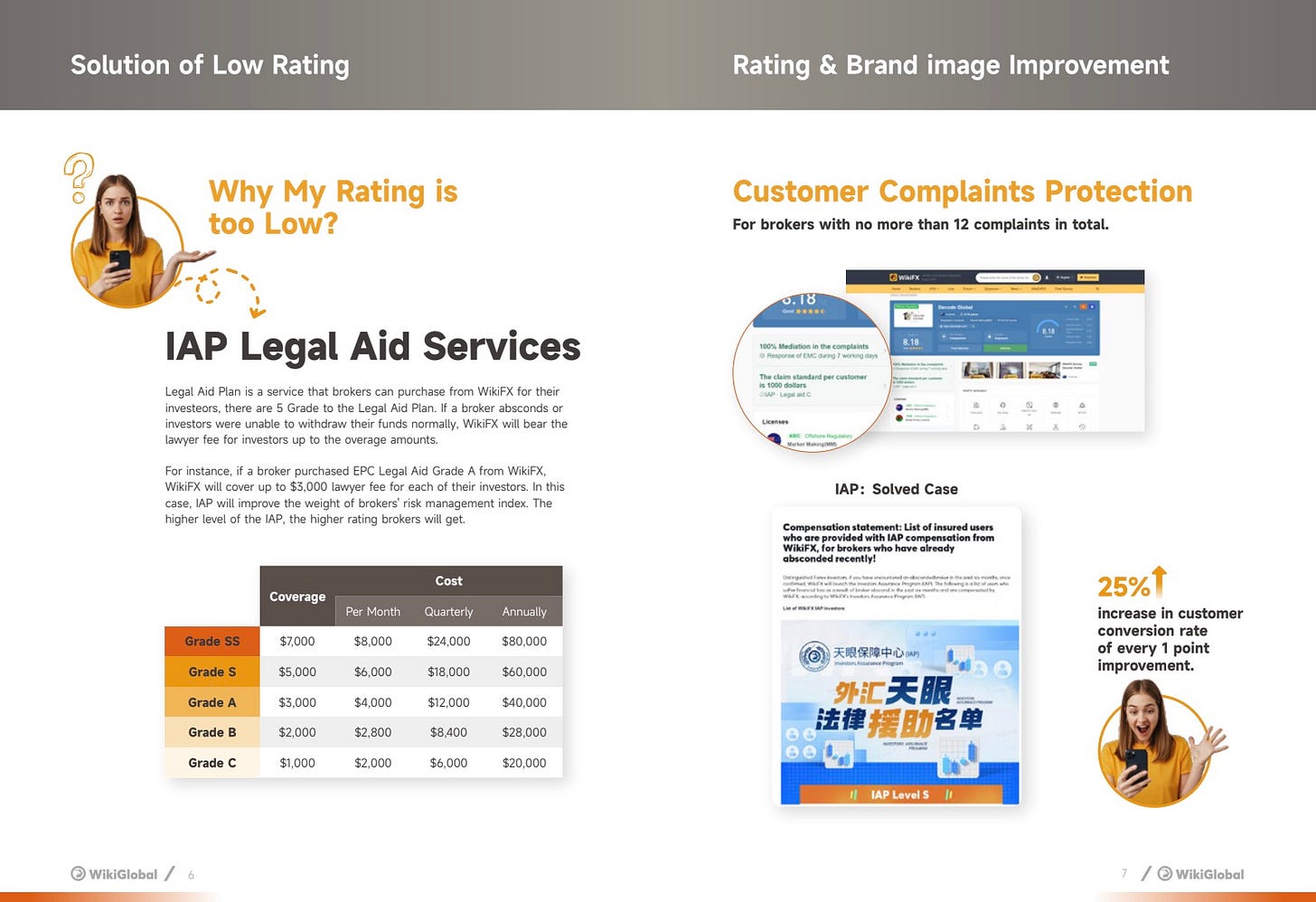

$3,000/month to suppress investor complaints.

$7,000/month to appear as the #1 ranked broker.

$20,000/year to be listed as “verified” regardless of license quality.

The system is real. And now, so is the exposure. They don’t regulate. They don’t verify. They sell reviews. They sell removal. They sell reputation. Starting now, the truth belongs to the public. Let the world see what you really are.

Background

WikiFX presents itself as a global authority on forex broker verification. On its website and in marketing materials, it claims to provide regulatory transparency to retail investors by offering broker ratings, license checks, and risk assessments.

To the outside world, it appears to function like a neutral watchdog; an information source built to help users make informed decisions in an unregulated market. The tone of the platform suggests impartiality. Its language implies investor protection.

But in 2023, FXPrimus was directly contacted by WikiFX with an offer that told a very different story. In a recorded conversation with one of their representatives, WikiFX proposed a commercial arrangement: FXPrimus could have its name removed from public regulatory alerts on the platform if it agreed to work with them.

“Work with us”, as it was framed, meant entering a paid agreement.

The representative also offered services to raise FXPrimus’ score, make the company appear more trustworthy, and boost its presence on the platform through homepage exposure, banner placements, and preferred rankings. At no point were these improvements tied to any actual compliance process or due diligence.

They were available immediately as long as the company paid.

Shortly after the call, WikiFX followed up with a formal sales deck and a custom offer sheet titled “Malaysia Market Solution for FXPrimus 2023”.

These documents confirmed the pricing structure behind everything that had been promised: the suppression of complaints, the purchase of trust signals, and the public repositioning of FXPrimus on WikiFX’s platform.

The contradiction between the public-facing brand and the internal offer was stark. WikiFX claimed to protect investors.

In reality, it was offering to sell trust on demand, and at scale.

WikiFX Documents

Original Post by Michael Margaritis

Got a tip or story? Contact callan@scamurai.io.