U.S. files record $15b bitcoin forfeiture in case targeting Cambodia’s Prince Group

Its chairman, who remains at large, could face up to 40 years in prison.

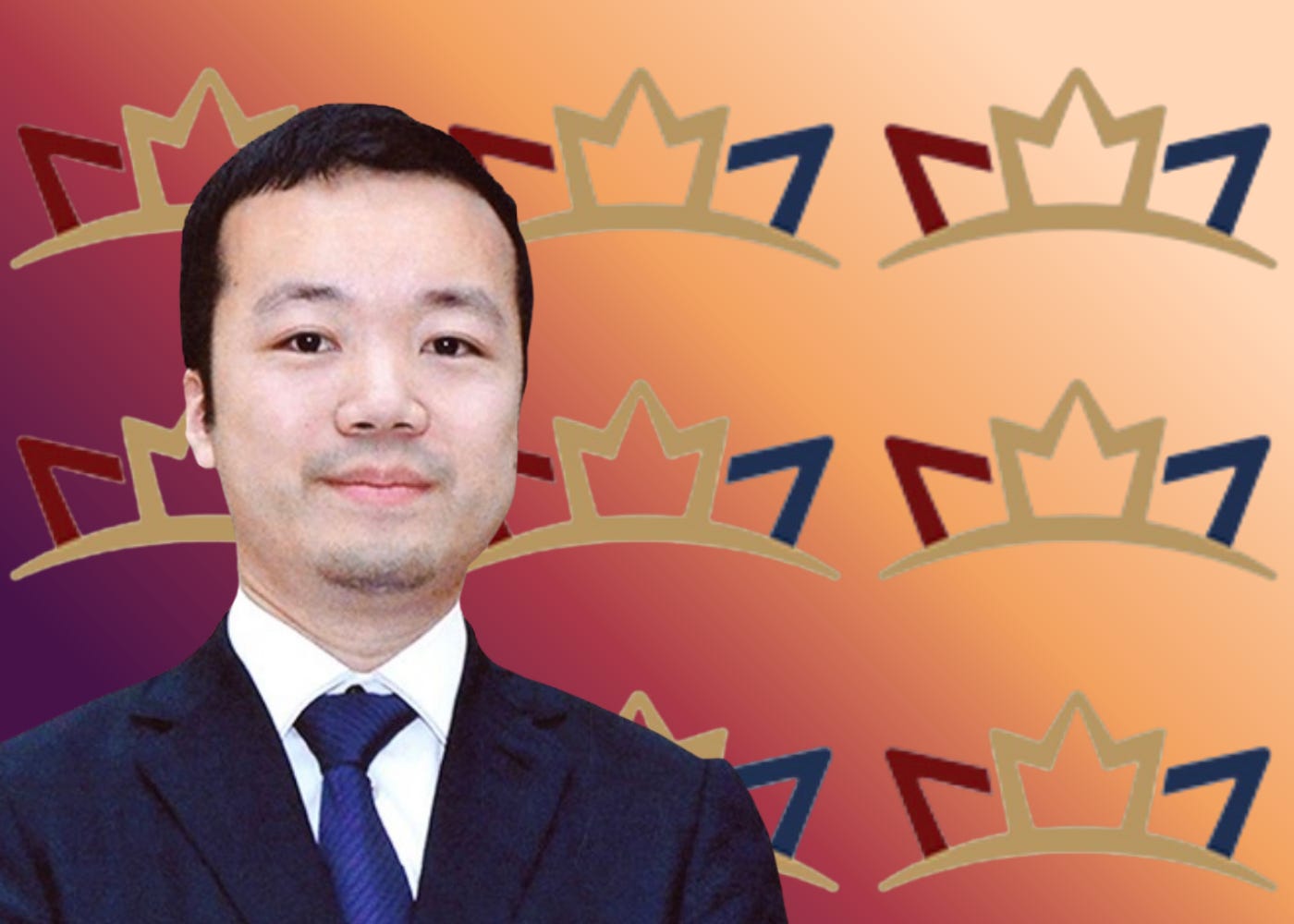

The U.S. Department of Justice has filed its largest-ever cryptocurrency forfeiture action, seizing around $15 billion in bitcoin linked to Cambodia-based Prince Holding Group and its founder, Chen Zhi, also known as Vincent Chen.

According to the Oct. 14 indictment, Chen and the Prince Group ran extensive human trafficking and cyber-fraud operations. U.S. authorities described compounds in Cambodia where victims were held against their will and forced to carry out so-called “pig butchering” cryptocurrency investment scams that defrauded billions from victims around the world.

The forfeiture, filed in the Eastern District of New York, covers approximately 127,271 bitcoin currently held in U.S. custody. Prosecutors say the funds represent the proceeds of criminal schemes tied to Prince Group’s operations, and that Chen personally controlled the private keys to wallets storing the cryptocurrency.

Federal prosecutors also charged Chen with wire fraud and money laundering conspiracies tied to alleged forced-labor scams in Cambodia. Chen remains at large. If convicted, he faces up to 40 years in prison.

Attorney General Pam Bondi said the forfeiture marks a milestone in international cybercrime enforcement. “[The] action represents one of the most significant strikes ever against the global scourge of human trafficking and cyber-enabled financial fraud,” she said.

“By dismantling a criminal empire built on forced labor and deception, we are sending a clear message that the United States will use every tool at its disposal to defend victims, recover stolen assets, and bring to justice those who exploit the vulnerable for profit.”

Get the weekly newsletter delivered fresh and ironed to your email each week, with the latest news on scams, fraud and tech, as well as Scamurai’s latest investigations — all in one place! Every Friday morning at 8am GMT.

Prince Holding Group, one of Southeast Asia’s largest conglomerates, spans more than 100 businesses in 30 countries. The company’s size and political influence have made it a significant economic and social player in Cambodia, and, prosecutors say, a dangerous front for cybercrime on a global scale.

Its legitimate holdings include investments in real estate, hospitality and financial services, but U.S. authorities allege that the group’s global footprint also facilitated a vast web of online scams, human trafficking and illicit money laundering.

The indictment details a complex network of fraud compounds run by Prince Group, including sites in Sihanoukville, Kandal, and Kampong Speu provinces. Workers there were trafficked, confined, and forced to scam victims worldwide, often under the threat of violence. The compounds contained dormitories surrounded by barbed wire and heavily guarded perimeters. Investigators say Chen was personally involved in managing the operations.

Prosecutors say Chen oversaw a network of money mules in New York who helped cash out funds between 2020 and 2022. The group’s scams, according to one co-conspirator cited in the indictment, once generated as much as $30 million a day.

Andrew Fierman, Head of National Security Intelligence at Chainalysis, said the latest action effectively cuts the Prince Group off from the U.S. financial system. “[This means] their existing network of fiat operations will not be able to transact effectively using U.S. dollars,” Fierman said.

“*However, as they have attempted to distance themselves from scam operation affiliations... have created an extensive network of shell companies across jurisdictions and laundered funds through cryptocurrency mining, it appears this group is motivated to evade detection,” he added.

“As with any illicit actors seeking to evade sanctions, they will often seek new mechanisms to bypass detection, so only time will tell how and if they’ll adjust their operations.”

Fierman warned that the dismantling of such large-scale criminal enterprises often also leads to fragmentation rather than disappearance. Past crackdowns* have shown that operations can quickly migrate, rebrand or shift platforms, while newer, less known players often seek to fill the void.

”Even when groups appear to shut down, they may resurface under new names or structures, often having taken steps to future-proof the risk and impact of regulatory action. Cybercriminal groups facilitating global scam operations are creative and resilient,” he said.

“That said, with the right strategies, enhanced compliance at the exchange and protocol level, advanced blockchain intelligence, and global law enforcement cooperation — authorities and the private sector can seek to disrupt these illicit networks as they adapt.”

The Justice Department’s announcement came just one day before the U.S. Treasury’s Financial Crimes Enforcement Network formally severed another major Cambodian entity, the Huione Group, from the U.S. financial system.

Huione has been identified as a key money-laundering hub for North Korean cyber operations and Southeast Asian scam networks. It too is part of a large Cambodian conglomerate with ties to the ruling Hun family.

Get the weekly news roundup straight to your inbox every week by subscribing. Or consider supporting Scamurai with a paid subscription.

Tips, vitriol and all other messages should be directed to Callan Quinn at callan@scamurai.io.