SEC Charges PGI Owner in $200m Fraud Scheme, Alleges $57 Million Spent on Luxury Goods

Ramil Ventura Palafox used investor money to fund a luxury lifestyle of Lamborghinis, Cartier bling and high-end property.

The US Securities and Exchange Commission (SEC) has charged Ramil Ventura Palafox, founder of a collapsed crypto and foreign exchange trading firm, with defrauding investors out of $198 million.

According to the SEC, Palafox misappropriated over $57 million of that money to buy luxury cars, jewellery, designer goods and property.

"Palafox promised investors guaranteed profits from sophisticated crypto and forex trading, but instead spent their money on cars, watches and homes," said Scott Thompson, associate director of the SEC’s Philadelphia Regional Office, in a statement.

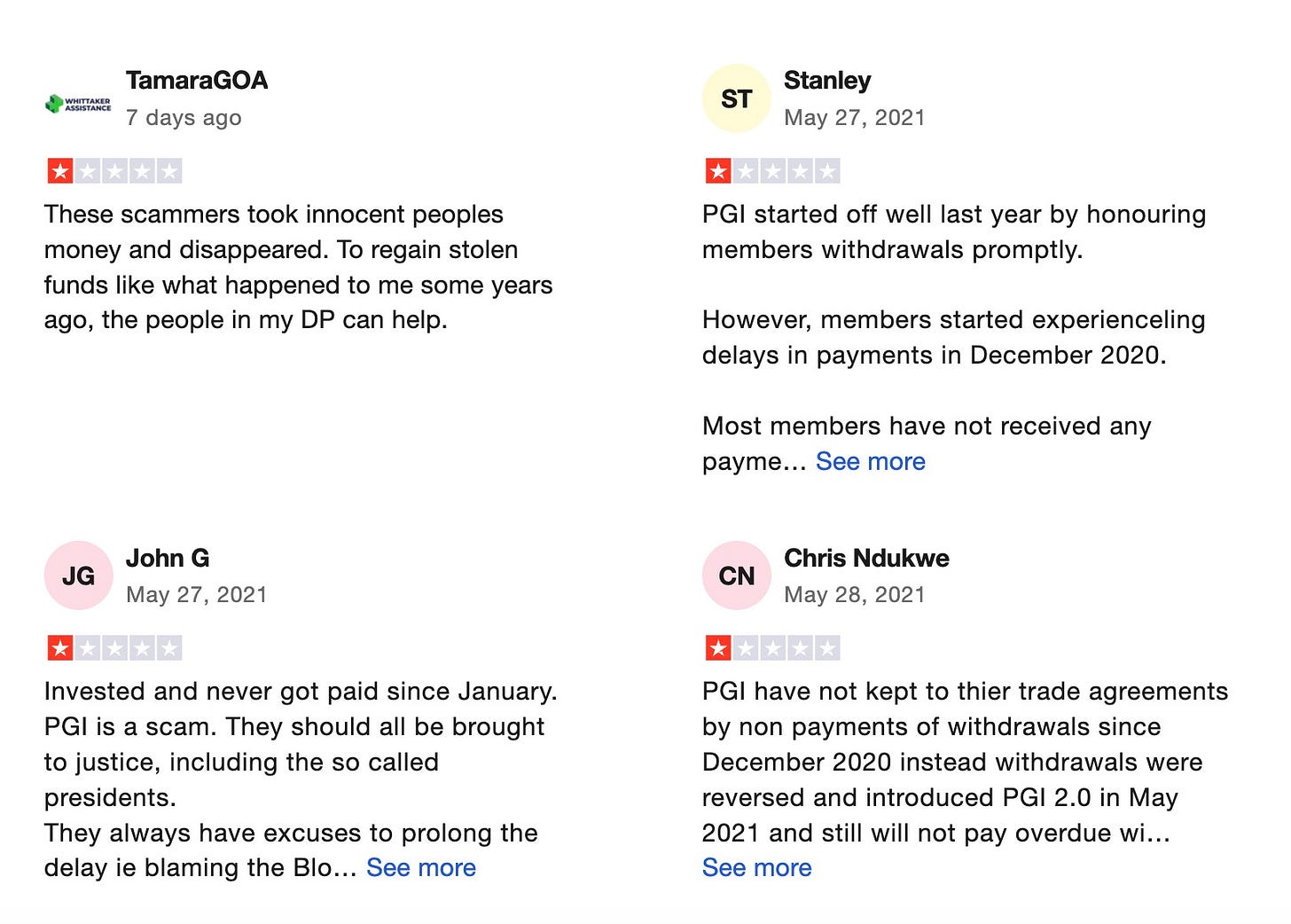

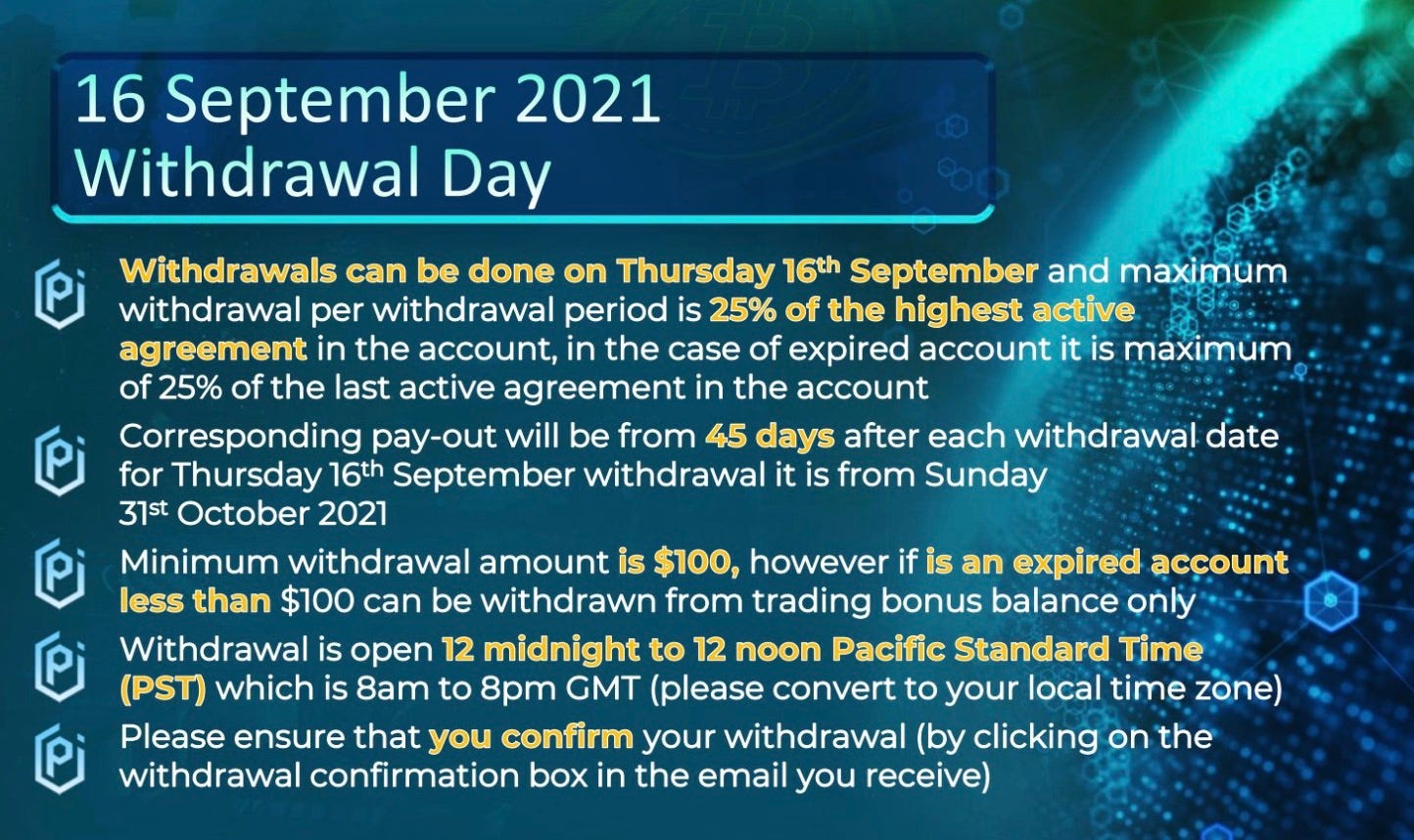

The SEC alleges that between January 2020 and October 2021, the 59-year-old used his company PGI Global (also known as Praetorian Group International Trading) to sell "membership" packages with the lure of high returns. The firm operated like a pyramid scheme, offering bonuses for recruiting new investors.

At the time, Palafox was based in California and Nevada.

Rather than being used for trading, much of the money was funnelled into personal luxury spending. The rest was used to pay earlier investors with money from newer ones, a typical tactic used in Ponzi-style operations.

PGI Global’s website went offline in June 2021. A month later, Palafox publicly denied the company was shutting down and claimed investors would be repaid. However, regulators say he continued moving funds to entities he controlled, including one called BBMR.

Although he resigned as CEO in September 2021, Palafox kept control of company accounts. Efforts to reboot PGI Global under UK nationals Helen Graham and Claire Wilkinson failed, and US authorities seized the site in October 2021.

The SEC's complaint accuses Palafox of violating anti-fraud and registration laws. The regulator is seeking permanent injunctions, repayment of illicit gains with interest, financial penalties, and a ban on Palafox participating in similar schemes.

Palafox has also been criminally charged by the US Attorney’s Office in Virginia.

This isn’t the first time Palafox and PGI Global have faced regulatory heat. In 2022, the UK High Court shut down the company’s British arm. A UK Insolvency Service investigation found that investors had been promised returns of up to 200%. When those failed to materialise, they were unable to retrieve their funds. Palafox, the sole director, did not cooperate with the probe.

Three UK bank accounts linked to PGI Global received around $815,000 between July 2020 and February 2021. At least $260,000 was funnelled into personal accounts.

Several members of Palafox’s family have been named as relief defendants in the SEC complaint, a legal term used when individuals are not directly charged but are said to have benefitted from stolen funds.

His wife, Marissa Mendoza Palafox, allegedly received over $1.18 million in Cartier jewellery and spent another $88,000 at high-end retailers such as Tiffany & Co. and Chanel.

His mother, Linda Ventura, is reported to have received a mortgage payment of just over $169,000 and a Range Rover. His brother-in-law, Darvie Mendoza, who was paid an annual salary of $22,500 by PGI Global, also received a $320,000 mortgage payment.

Palafox himself used approximately $1.7 million of investor money to buy personal property while the scheme was active.

Palafox and PGI could not be reached for comment.

Read More

Get the latest news, scoops and insights to you inbox each week by subscribing to the Scamurai weekly newsletter. Got a tip or story? Contact us at callan@scamurai.io.