Crypto laundering network Huione thrives despite supposed shutdown

Huione’s daily transaction volumes grew even after FinCEN targeted the platform as a money laundering threat.

Huione, the Chinese-language money laundering platform based in Cambodia, appears to be thriving despite U.S. government attempts to dismantle it.

Transaction volumes on Huione’s platform averaged $144.5 million per day in May, up from $130.2 million before the announcement, according to data provided by blockchain analytics firm Chainalysis.

“Generally, this increase follows a longer run trend,” said Eric Jardine, Cybercrimes Research Lead at Chainalysis told Scamurai.

He added that from November 2024 to February 2025, Huione received an average of around $100-110M a day. These inflows increased to around $130M during both March and April and reached almost $145M in May.

On May 1, U.S. financial regulator FinCEN began taking action to designate Cambodia-based Huione as a primary money laundering concern. The FinCEN designation, if finalised, would isolate Huione from the U.S. financial system. It followed earlier actions including takedowns of Huione’s website and Telegram channels.

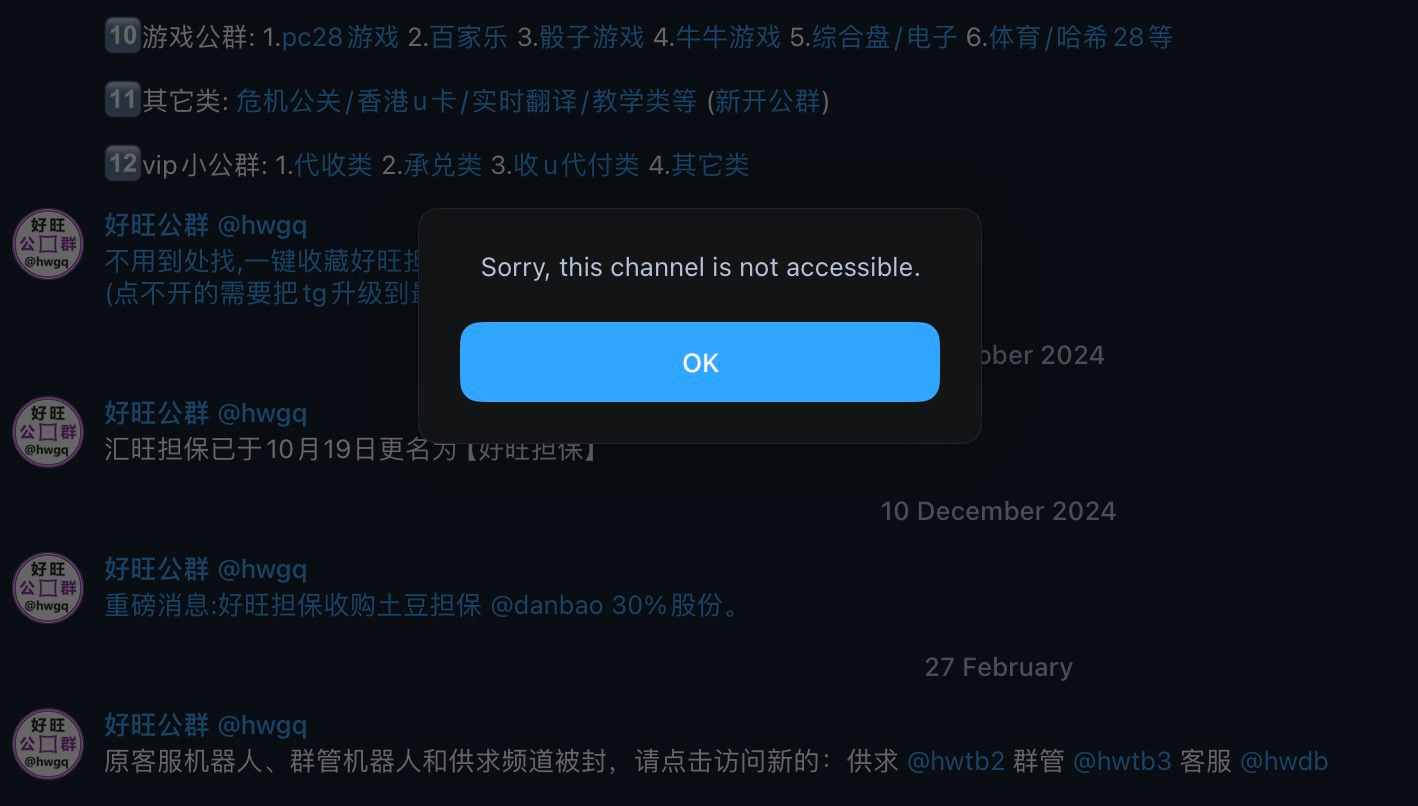

Despite announcing its closure, Huione Guarantee has since rebranded its guarantee service as "Haowang Guarantee" and migrated to a new domain, continuing operations largely uninterrupted.

Founded in Cambodia, Huione runs several services but its guarantee service in particular has faced mounting controversy over its role in laundering funds linked to fraud, pig butchering scams and cybercrime. Its guarantee service acts as a platform facilitating anonymous transactions between illicit actors.

Hun To, the cousin of current Cambodian leader Hun Manet, is a director for Huione subsidiaries Huione Pay and Huione Insurance. Huione Pay previously provided links to Huione Guarantee on its website. They have since been removed.

In May, the number of distinct counterparties interacting with Huione rose 16% month-over-month, from 331,000 to 385,000. The average transaction size also ticked up to $4,000 from $3,900, although Jardine said this was not considered abnormal compared to historical data.

“This increase seems broadly in line with the long-run up and to the right trend in Huione counterparties overall,” Jardine added.

The persistence of Huione highlights the broader challenge in combatting Chinese-language laundering networks. Other platforms like Tudou Danbao, reportedly 30% owned by Huione, have seen explosive growth in user activity, albeit with smaller dollar volumes.

Over the past year, Huione has also tried to branch out further into crypto, launching a cryptocurrency exchange platform has returned to the scene.

It has also rebranded its blockchain, formerly known as Huione Chain, and relaunched it at Xone.

Got a tip or story? Contact callan@scamurai.io.