Cashless society kinda sucks

As digital payments surge, the quiet death of cash isn’t just an old person’s panic. It’s a real threat to privacy, resilience and freedom.

On some Saturday mornings in Bexhill-on-Sea, a sleepy seaside town on England’s geriatric coast, a fringe right-wing group called The Light hands out free newspapers in the square. It’s the usual tinfoil buffet with pieces on the Illuminati, vaccines and shadow cabals, but there’s one particular cause célèbre of theirs that’s harder to dismiss: save cash.

Plenty of local businesses have put up signs in their windows supporting the use of cash and warning about the risks of Central Bank Digital Currencies (the shop staff I asked said some guy came around with the posters a few years ago). But across the UK and globally, more and more cafes, shops and restaurants are going cashless.

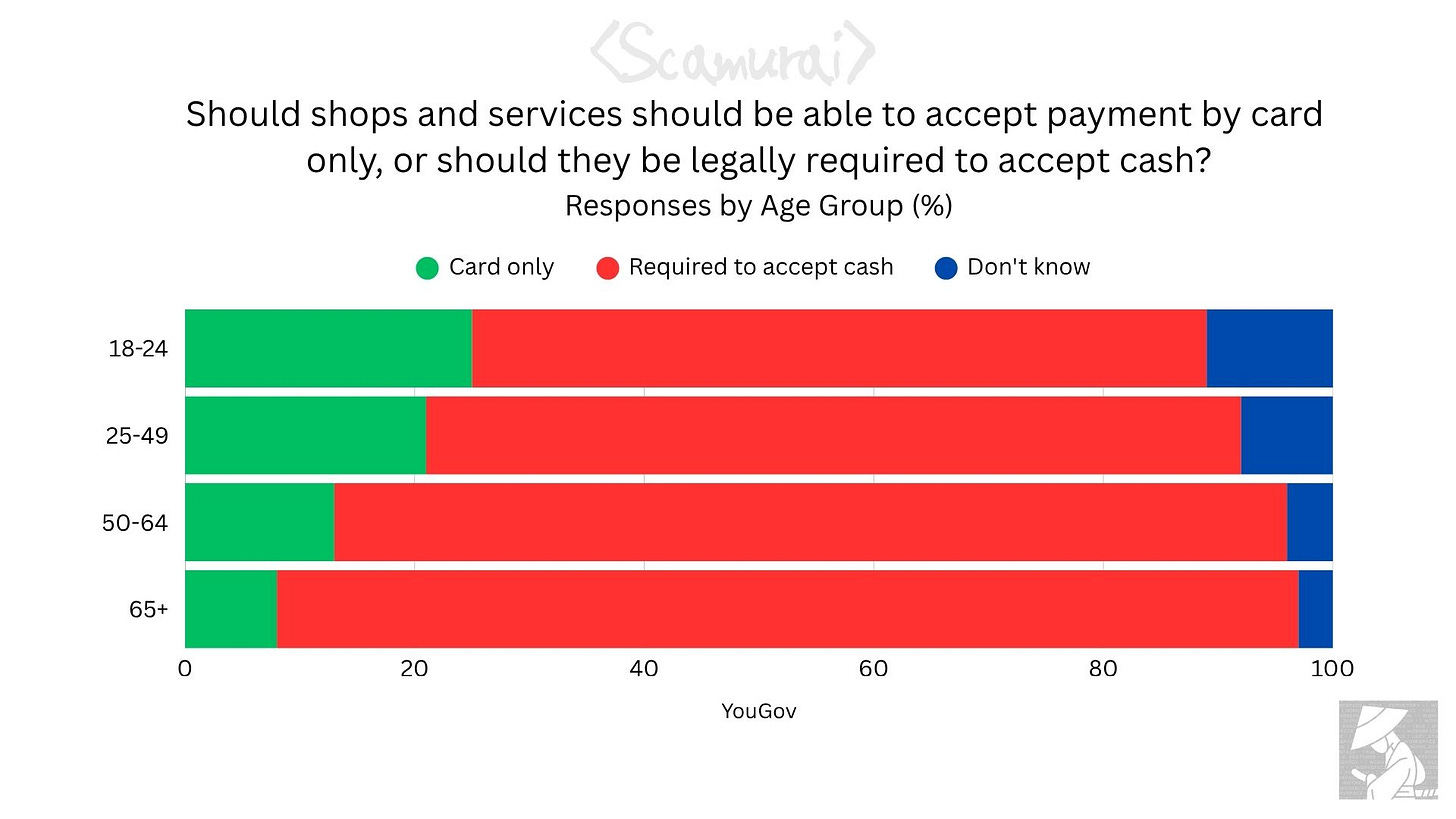

The UK doesn’t currently require businesses to accept cash. If a shop wants to go card-only, that’s their right. But a January YouGov poll found that a whopping 77% of UK adults think shops and services should be legally required to accept physical currency.

Support was strong across the country, a bit higher among women (81%), Conservatives and Reform voters, and especially among working class people (82%). But even 64% of Gen Z respondents backed laws requiring cash acceptance.

Despite overwhelming public support, the UK government is dragging its feet. It’s acknowledged the issue and released a report this July, but there's been little to no meaningful legislation to guarantee people can actually use the money printed by the Bank of England.

Meanwhile, the infrastructure that supports cash is crumbling.

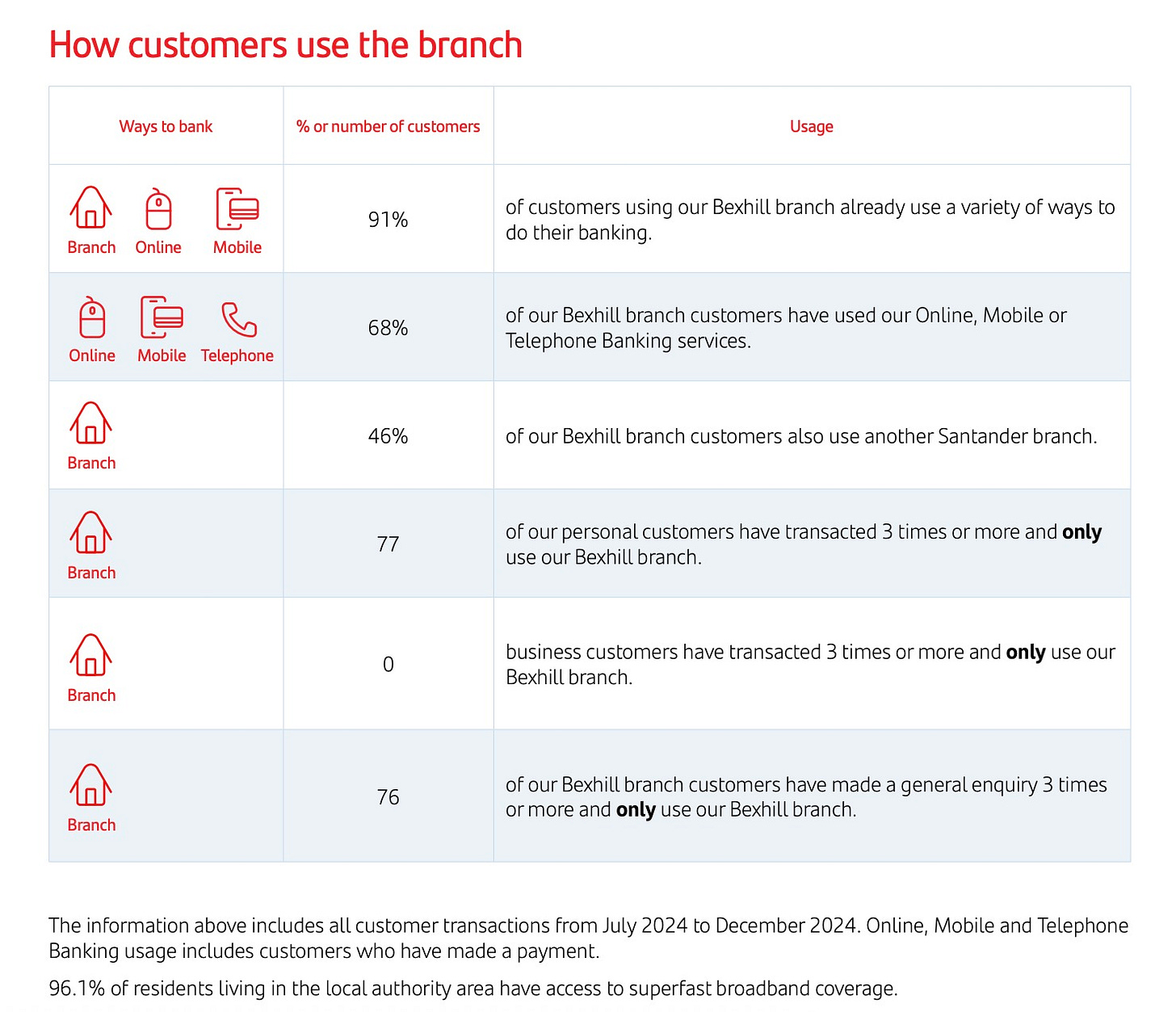

In Bexhill (population 44,000), residents are concerned about cash access. Only one bank branch remains in the town, a Nationwide, after the closure of Santander in June.

Nationwide has responded by putting up cheeky posters saying, “Santander is closing their Bexhill-on-Sea branch. Maybe it’s time you closed your Santander account.”

Sassiness aside, it highlights a broader problem. As banks close, so do their ATMs. Access to cash gets harder. That particularly affects elderly people, the disabled, people in rural areas and anyone who can’t or won’t use digital payment systems.

Yet this isn’t just about making life harder for pensioners buying their paper. The loss of cash has far bigger implications.

A world without cash is a world where every transaction is trackable. Where tech platforms mediate formerly simple exchanges. Where outages or hacks could grind daily commerce to a halt.

For all that people laud cryptocurrency or the latest fashionable fintech company as a privacy-preserving method of payment, they ignore that cash does the same thing far better and without middlemen taking cuts.

It’s an independent, government-backed payment system that doesn’t require electricity, software updates or data-sharing agreements to use (crypto proponents may argue blockchain doesn’t require these either, but the platforms and services people use to interact with blockchains certainly do).

If I don’t want tech giants or the government to know how many bars of Dairy Milk I’ve bought this week, paying in cash is the only real way to ensure my privacy.

It’s also tangible. Spending with physical cash makes you more conscious of your money than tapping a card or scanning a phone. It makes budgeting easier.

Yes, cash is already vanishing. In 2013, it accounted for 51% of all UK payments. By 2023, that had plummeted to 12%, according to UK Finance (a lobby group for the financial services industry). While handling cash has costs, the jury is out on whether digital payments are actually cheaper for businesses, especially smaller ones. Hidden fees, equipment and platform lock-in all add up.

Cash is still widely used in my hometown but elsewhere its a different story. In London, I’ve seen cash refused on buses, at coffee chains, fast food joints and car parks. A few years ago Croydon, a payment system glitch meant that traffic wardens had to let everyone out of a car park for free.

Try using cash these days even further afield in places like China. People look at you like you’ve tried to pay with magic beans.

Cashless society and unnecessary digital systems being foisted on people aren’t new. My secondary school scrapped cash for school meals about 15 years ago. Lunches had to be bought using thumbprint scanners. No consent. No opt-out. No idea what happened to the data that was collected.

Cash access and acceptance isn’t on the agenda in many places, but there are some exceptions. France mandates acceptance of cash in most situations, with fines for refusal.

Australia, in a December 2024 consultation paper, proposed requiring businesses to accept cash to ensure inclusion, budgeting, resilience and consumer trust.

So yes, Bexhill’s sandwich board cranks may be right about one thing. The disappearance of cash should worry us. Because a society that depends entirely on digital payments is a society that depends entirely on fragile systems, greedy middlemen and increasingly unaccountable tech firms.

Today, you can tap your card freely. Tomorrow, they might start charging for the privilege. And when the lights go out? Good luck tapping anything.

Interested in contributing an opinion piece, rant or lengthy diatribe to Scamurai? Send your pitch to callan@scamurai.io.