British "finfluencers" given court dates amid FCA efforts to clamp down on unauthorised promotions

A trio of social media personalities will face trial for promoting risky investments.

Three British ‘finfluencers’ who touted luxury lifestyles to sell trading courses are set to face trial in 2027 after being charged with promoting high-risk financial products without authorisation, a London court decided last week.

Charles Hunter, 29, from Exeter; Kayan Kalipha, 35, from London; and Luke Desmaris, 30, from Harlow, each face a single count of unlawfully communicating an invitation to engage in investment activity under Section 21 of the Financial Services and Markets Act 2000. If convicted, they could face fines and up to two years in prison.

The cases centre on the trio’s promotion of Contracts for Difference (CFDs), complex and highly leveraged forex trading products that can wipe out investor capital quickly. The FCA estimates that around 80% of retail investors lose money on CFDs. Despite restrictions on marketing these products to ordinary consumers, Hunter, Kalipha and Desmaris each allegedly promoted them through their platforms.

The FCA declined to comment to Scamurai on the ongoing cases but confirmed they form part of a broader crackdown on illegal financial promotions. Earlier this year, the regulator coordinated with nine overseas agencies in a sweeping operation that led to arrests, interviews and more than 650 social media takedown requests. It has also charged nine individuals in a separate case tied to an unauthorised foreign exchange scheme.

According to the FCA, the problem of finfluencers has ballooned in recent years. Its 2024 Financial Lives Survey found that nearly one-third of Britons sought investment guidance via Google, while social media platforms were the second most common source of financial advice. Only 9% of consumers, by contrast, received regulated financial advice.

Young people are particularly exposed. Nearly two-thirds of UK residents aged 18 to 29 follow social media influencers, and nearly three-quarters say they trust their financial advice. The FCA says this trust can be dangerously misplaced when influencers promote unregulated, high-risk products.

Fast cars and big houses

Finfluencers, as the FCA defines them, are not inherently bad actors. Many operate within the law, sharing budgeting tips or legitimate investing education. But others exploit the blurred line between ‘lifestyle content’ and ‘financial promotion,’ using ostentatious imagery to lure followers into schemes that could be ruinous.

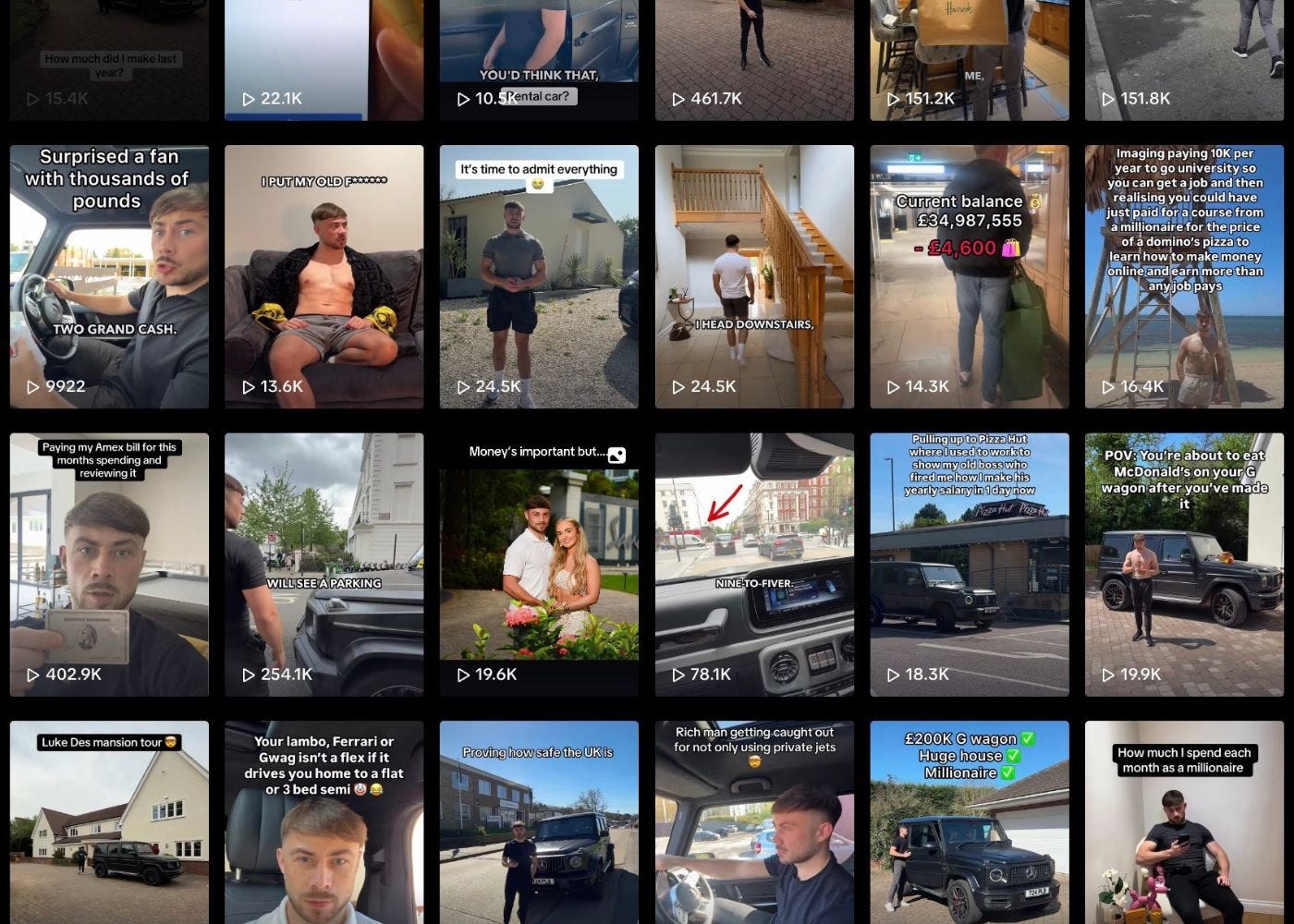

In the case of Hunter, Kalipha and Desmaris, each cultivated a classic hustle culture aesthetic of fast cars, rented mansions and tales of rags-to-riches trading success. Yet beneath the luxury sheen lay familiar patterns of misleading claims and unverifiable results.

It is not clear to what extent they owned the properties displayed in question – a common tactic among such influencers is to be misleading about the houses and cars they own by hiring spaces or vehicles to film their videos.

In Desmaris’ case, his Instagram and TikTok pages show him flaunting a luxury house that is surprisingly bereft of furniture or signs of actually being lived in. His website describes him as coming from a modest household and becoming a millionaire in his mid twenties through trading.

“Luke did not get good grades in school and found it uninteresting. He always wanted to persue [sic] entrepreneurship and work for himself,” his website stated.

“After dropping out of sixth fom [sic] , Luke found himself working some dead end jobs after leaving school in sixth form until he had enough and persused [sic] his ambiotions [sic] and desires of becoming a millionaire which he achieved through various online revenue streams by the time he was in his mid 20s.”

In his videos, he brags about flaunting UK driving laws, including using bus lanes to bypass traffic, “cos I’m a millionaire and don’t care about the fines”. In an article from the tabloid The Sun, which he links to on his personal site, he discusses parking violations and how he doesn’t care bout receiving thousands in fine because of his wealth.

He runs a crypto and forex trading community online and on Telegram that costs £30 to join, and claims to have taught over 10,000 people (Scamurai was unable to verify this). He has 127,000 followers listed on his TikTok account.

The other two followed a similar modus operandi. Kayan Kalipha ran a similar website called Kalipha Markets, that seems to have shut down at some point after August 2025, the last available page on the Wayback Machine.

“Kayan’s provides high quality education and trading signals based on macroeconomic Fundamentals strategies overlayed with Technical analysis and risk management when trading the forex, stocks, crypto and commodities markets. His unique approach is based on understand economic developments the cause fundamental market moves,” his website stated.

Meanwhile, Charles Hunter runs Tips2pips, which follows the same business model. On his Instagram, he posts flash cars to his 97.2k followers, flashing cash and jet skis and quad bikes.

Fighting back

In 2024, the FCA tightened its guidance on financial promotions across social media, clarifying that the same standards apply to influencers as to traditional firms.

It has also worked with major platforms, including Google, Meta, X, and TikTok, to block unauthorised financial ads. Paid financial promotions on these platforms are now restricted to advertisers authorised by the FCA, a move that has sharply reduced the number of scam ads but not removed them entirely.

Still, the regulator admits illegal promotions remain too common. Despite notable progress, the FCA says tech companies must do more. “Third parties hosting unlawful content need to identify and remove it proactively, without relying on the FCA to do this for them,” a spokesperson said.

Get this newsletter straight to your inbox every week by subscribing. If you can, consider supporting Scamurai with a paid subscription.

Tips, vitriol and all other messages should be directed to Callan Quinn at callan@scamurai.io. Or get in touch below.